Ssn Withholding 2025. Are social security benefits taxable? This amount is known as the maximum taxable.

If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025. A retiree can use the tax withholding estimator to enter any pension income or social security benefits they or their spouse receive.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

Social Security Tax Withholding Form 2025, Fica is a payroll tax, and it's short for the federal insurance contributions act. The estimated average social security benefit for retired workers in 2025 is $1,907 per month.

50 Essential Tips Maximizing Tax Withholding on Social Security 2025, What is the social security tax limit? We raise this amount yearly to keep pace with increases in average.

How To Calculate, Find Social Security Tax Withholding Social, In 2025, the social security wage base limit rises to $168,600. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

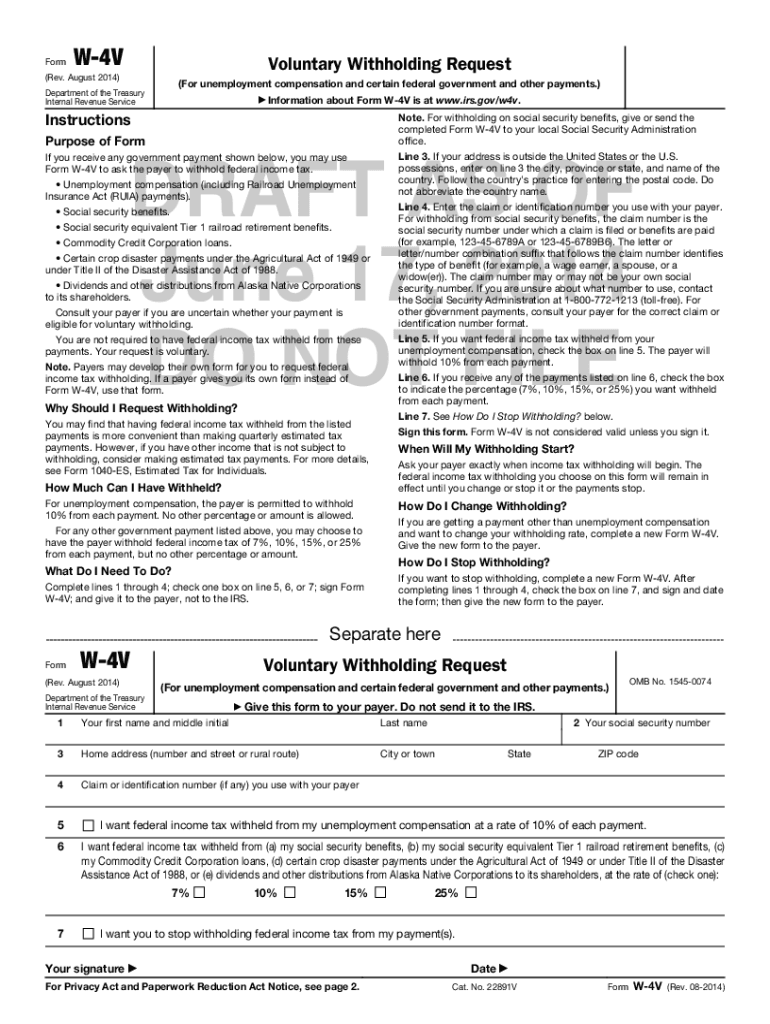

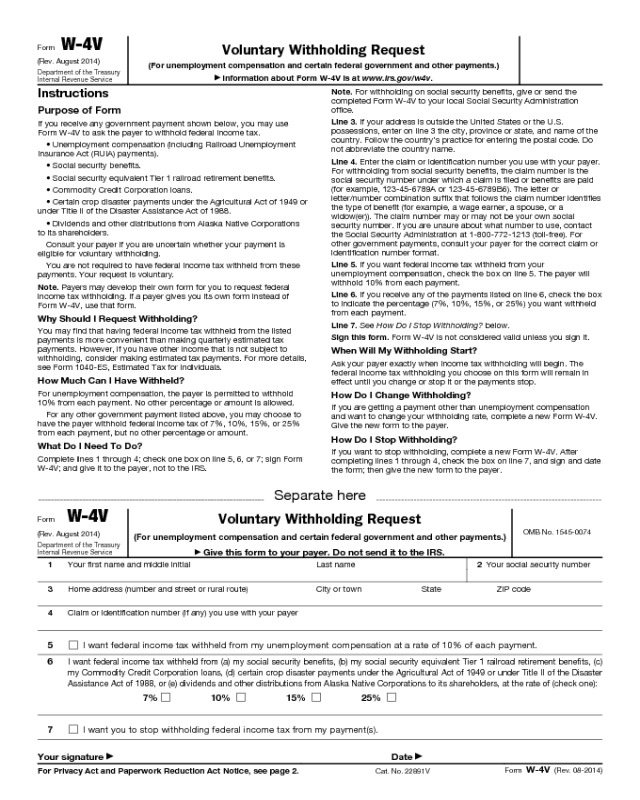

Social Security Tax Withholding Forms, The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The law requires employers to withhold a certain percentage of an employee’s. Fica is a payroll tax, and it's short for the federal insurance contributions act.

Social Security 2025 Wage Limit Alie Lucila, In 2025, the social security wage base limit rises to $168,600. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

Social Security Tax Withholding Form W4V 2025 Printable 2025 W4 Form, The maximum amount of social security tax an employee will have withheld from. Social security and medicare tax for 2025.

Social Security Withholding Calculator 2025 Tax Withholding Estimator, Social security and medicare tax for 2025. Fica is a payroll tax, and it's short for the federal insurance contributions act.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For earnings in 2025, this base is $168,600. If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement.